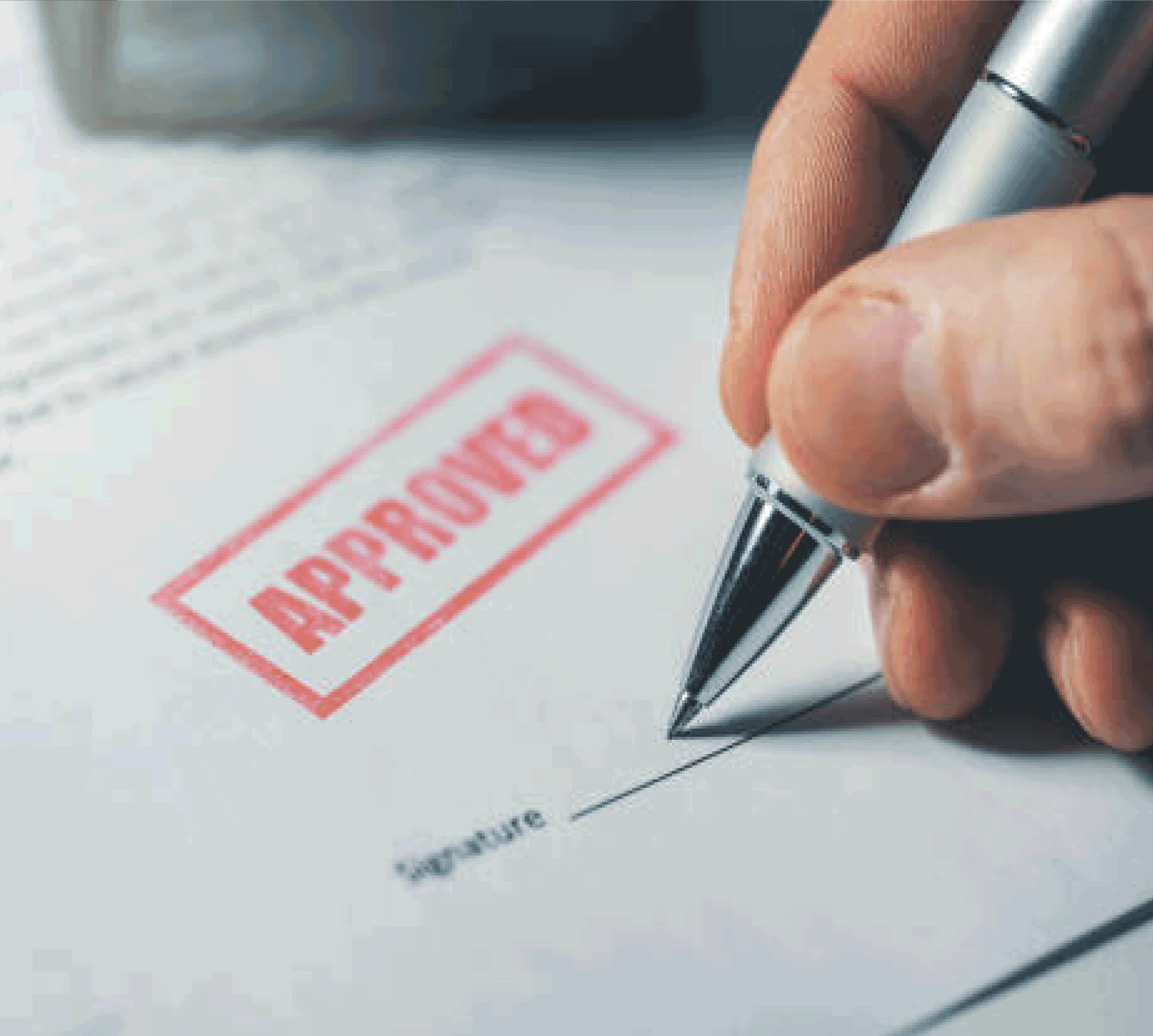

Credit Profile Restoration

Your credit profile is more than just a score; it’s a representation of your financial health and reliability. At Debt Off Services, we specialize in Credit Profile Restoration, a comprehensive process aimed at clearing negative listings and helping you rebuild a strong, credible financial profile. Whether you’ve experienced financial setbacks due to debt review, defaults, or judgments, we provide the guidance and expertise you need to regain control.

What Makes Our Process Different?

1

Comprehensive Analysis

We start by conducting a detailed review of your credit report to identify all negative listings, errors, and outdated information that may be affecting your creditworthiness.

2

Dispute Resolution Expertise

Our team works directly with credit bureaus and creditors to dispute inaccuracies, outdated entries, and fraudulent listings on your credit report. We ensure your record reflects accurate and up-to-date information.

3

Debt Settlement Support

For legitimate debts, we assist in negotiating settlements and securing clearance certificates, ensuring that your credit record is updated accordingly.

4

Customized Financial Planning

We don’t just clear your record; we help you maintain it. By offering personalized advice on budgeting, debt management, and financial planning, we empower you to avoid future

financial pitfalls.

5

Client-Centric Approach

We understand that every client’s situation is unique. Our team provides tailored solutions that align with your specific circumstances, ensuring that your journey to financial recovery is as smooth as possible.

6

Proven Track Record

Our success stories include clients who have gone on to secure loans, buy homes, and achieve their financial dreams after working with us. With Debt Off Services, you’re not just restoring your credit—you’re rebuilding your future.

Top Ten Frequently Asked Questions & Answers

If none of your questions are answered here, please feel free to chat directly with a consultant via our WhatsApp Chat or on the office lines displayed below

Why Choose Debt Off Services

Proven Track Record:

Our history is marked by numerous success stories of individuals in South Africa who have successfully eliminated debt reviews with our assistance. We have a track record of granting people a fresh start and helping them regain control of their financial lives.

Client-Centric Approach:

Your unique needs and circumstances are at the heart of our mission. We are committed to providing tailored solutions that align with your specific situation. We understand that one size does not fit all, and we strive to address your individual financial challenges.

Financial Freedom:

Our ultimate objective is to liberate you from the burden of debt review. We want to empower you to regain control of your financial destiny, ensuring that you can move forward with confidence towards a debt-free future.

Stay up to date with our blog and become debt-smart

A Beginner’s Guide to Debt Review Removal

January 6, 2025

Feeling stuck in debt review and unsure where to start your journey to financial freedom? You’re not alone, and we’re here to help! In this guide, we break down everything you need to know about

The Hidden Costs of Staying

Under Debt Review Too Long

January 9, 2025

Debt review may seem like a safety net, but staying in it longer than necessary could cost you more than just money. From lost financial opportunities to damaged credit scores, the hidden costs

Debunking 7 Myths About Debt Review Removal

January 11, 2025

There are countless myths about removing debt review—some say it’s impossible, others believe it ruins your financial future. The truth? Most of these fears are unfounded. In this post, we’ll bust the top